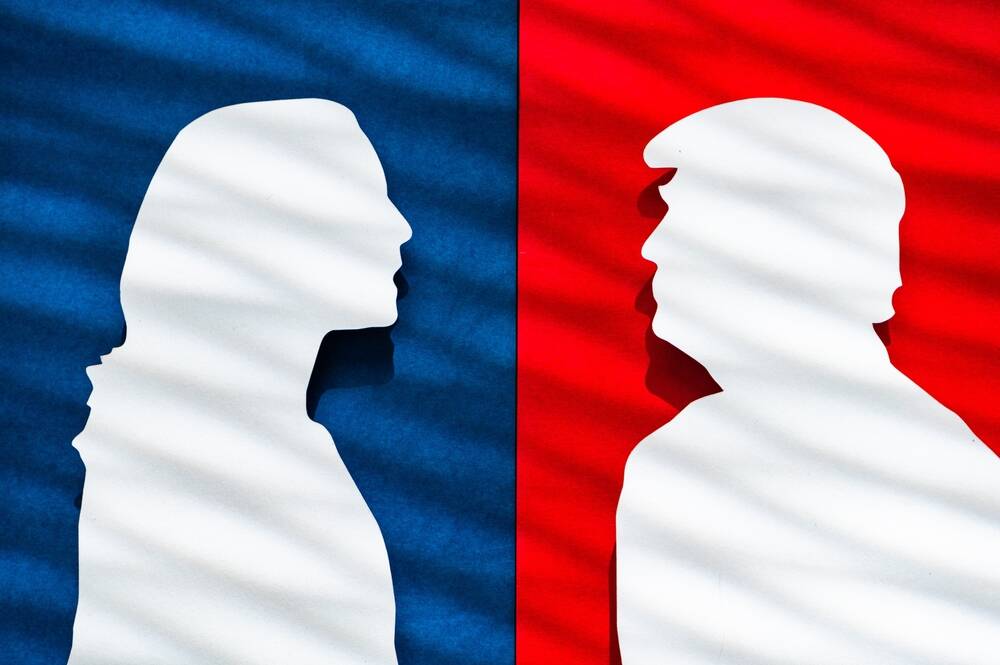

Can Election Shape Your Retirement Finances?

Elections can significantly impact the financial landscape of our country.

There is a very high possibility of changes that will affect retirees directly. Americans should understand that the elections mean a lot for our future, and choosing wisely who we are voting with is crucial. Social Security, Medicare, tax laws, and market volatility are some of the key factors in American society, and understanding their dynamics is crucial for making informed decisions.

Elections are a fundamental aspect of democracy, shaping the world we live in and the policies that govern our daily lives. By voting, we ensure our voices are heard and our needs are addressed. Understanding the significance of elections empowers us to make informed choices, ultimately affecting our families, neighborhoods, and futures. So, engaging in the electoral process is not just a right, but also a powerful tool we should take advantage of, because it shapes a better society for everyone.

So, can the election shape the financial lives of retirees? The answer is YES, they totally can.

The Importance of Staying Informed

Understanding the importance of staying informed can’t be overstated, especially for retirees. Elections are not really about selecting leaders, but about shaping policies that can drastically impact the course of our lives. The proposed changes to Social Security and Medicare are some of the most debated subjects during election season. These are lifelines for retirees and any little change can have profound implications on their monthly budges and access to healthcare services.

Staying informed basically means actively seeking out reliable information from trusted news sources, which provide in-depth analyses of candidates’ platforms and policy proposals. Furthermore, attending debates, participating in forums, and joining online communities focused on retiree issues can also offer valuable insights.

Social Security Changes

Social Security is a vital source of income for many American retirees, providing them with a safe feeling that helps them cover living expenses. The amount received is significantly influenced by the decisions made during elections. Politicians often propose changes to the Social Security system, such as adjusting benefit formulas, changing the age of eligibility, or altering cost-of-living adjustments (COLAs).

Let’s think that lawmakers would decide to increase retirement age. In this situation, many retirees may find themselves needing to work longer before receiving full benefits. Another thing that can significantly impact retirees’ purchasing power is changing how COLAs are calculated. When inflation rises, Social Security benefits need to remain stable so retirees can maintain their quality of life.

Healthcare Policies

Healthcare is another critical area where elections can have a significant impact on retirees. Many seniors rely on Medicare and any change can seriously affect out-of-pocket costs, coverage options, and access to care.

During election campaigns, candidates often debate healthcare reform, including potential changes to Medicare. Unfortunately, most of the time the politicians are just making promises they can’t satisfy. This is one of the main reasons a lot of people lost trust in political figures. There are a lot of debates going on about crucial subjects in our society but just a small percent of them are becoming reality. So, why would you vote with someone who is trying to sell you lies? The bad part is that most of the politicians have promised things they didn’t manage to achieve.

We shouldn’t be surprised that a lot of people are not voting, they can be totally understood if we have a look at the political scene of our country.

Any healthcare change, such as eligibility age, expanding benefits, or introducing new payment models can directly influence retirees, particularly those with chronic health conditions requiring regular care.

Moreover, the political climate can also affect private insurance markets. If new regulations apply, they can lead to increased premiums or changes in coverage for those who may need additional health insurance options. Retirees have to pay attention to these discussions and understand how they might impact their healthcare expenses.

Taxes and Retirement Income

Tax policies can also suffer changes during elections. For example, changes to income tax rates could impact how much retirees keep from their pensions, savings, and Social Security.

Additionally, property taxes can also become a big concern for retirees, especially for those living on fixed incomes. If local governments raise property taxes, it would make it hard or even impossible for retirees to afford their own homes. Some states offer property tax reductions for seniors, but these kinds of policies can also change with elections.

It’s important to understand the potential tax implications of different candidates because it allows retirees to plan their finances better, and most importantly, make informed decisions about their budgets.

Pension Plans and Retirement Benefits

The stability and funding of these pension plans can be influenced by political decisions. For instance, state and local governments often manage public employee pensions, and election results can affect their management.

If politicians prioritize pension funding, retirees may enjoy more security in their monthly benefits. By the other side, if there will be significant budget cuts, retirees may face reduced benefits.

Investments

Elections can also influence financial markets and investment strategies. Political stability, regulatory changes, and economic policies can impact stock prices and overall market performance. Retirees who rely on investments are most likely to experience significant changes by the outcomes of elections.

Planning for the Future and Engaging in the Electoral Process

Given the potential financial impacts of elections on retirees, it’s essential to engage in proactive planning. By doing so, they can advocate for policies that align with their needs and interests.

Finally, retirees should actively participate in the electoral process. Voting is one of the most powerful ways to influence the decisions that affect their lives.

Last but not least, here are some tips and tricks for retirees to help ensure a smooth transition into retirement, no matter the political results. Here’s how to maintain a fulfilling lifestyle in a world of chaos:

- Create a budget: it is crucial for managing your finances in retirement

- Understand Medicare and Health Insurance: it will help you avoid unexpected medical bills

- Explore Additional Income Streams: consider exploring part-time work or freelance opportunities

- Stay Physically Active: exercise regularly and take proper care of your health

- Stay Socially Connected: engage with friends, family, and community groups to combat loneliness and isolation

- Keep Learning: stay mentally sharp by keeping yourself busy

- Manage Your Investments Wisely: consider consulting a financial advisor

- Set Goals and Pursue Hobbies: try new things

- Prepare for the Unexpected: life can be unpredictable, so it’s essential to have a plan for unexpected expenses or emergencies

If you are a retiree, now you know how the elections may impact your lifestyle. But don’t lose your hope! Stay informed, vote, and follow the entire process. Your opinion and your voice matter. If you haven’t already purchased a personalized t-shirt for the election day, I totally recommend you do it. You can also purchase some for your friends and family and get into the election spirit. Make the best out of this important day and spend it with your friends and family while following the news. The T-shirts can be found on Amazon, they come in different colors and sizes so is impossible not to find one that fits your style!

Are you interested in learning more about retirement? You should also read: How to Retire with ZERO Savings.

1 thought on “The Financial Impact of Elections on Retirees”

Republicans have policies and philosophies that hurt people. Humans like Trump and his boss Musk r only interested in helping the top income earners. The MAGA sheep 🐑 r enablers. We r screwed.